September General Meeting Minutes

General Meeting

8 September 2021

Held online viz Zoom

The Zoom meeting room was opened at 4.55pm and the meeting commenced at 5.00pm

Host – Sandra Bartlett, Membership Co-ordinator

Sandy thanked everyone for joining and introduced the panellists that will follow a short administration segment:

- Rahul Lachman of Marsdens Law Group – presenting on Commercial, Rent and Employment Law

- Josephine Byrnes-Luna of Achieving Solutions Counselling & Mediation Services – presenting on wellbeing during COVID

- Belinda McLean of HR Focus – presenting on HR

- Karina Rauch of Kelly Partners – presenting on financial support

Welcome – Shaun Pereira, President

Shaun welcomed everyone to the virtual zoom meeting. He congratulated Ian and Leanne Wolf of Tony Wolf and Son Quality Printers on celebrating 60 years of business.

Secretary’s Report – Sandra Bartlett, Membership Co-ordinator

On behalf of Carla (Secretary), Sandra advised the Minutes from 9 June 2021, the last face to face meeting prior to COVID 19 lockdown were available on the website. The Minutes were moved by Sandra Bartlett, seconded by Karina Rauch, and accepted. Any business arising please see Carla Upfill, Secretary.

Treasurer’s Report – Karina Rauch, Treasurer

Karina presented the Treasurers Report.

June 2021 – total income $3,574, total expenses $6,794 leaving a net deficit for June of ($3,220) and bringing the YTD loss for 2020-2021 ($27608).

July and August 2021 – total income combined $27,467, total combined expenses $2,728 resulting in a combined net surplus of $24,739. This is due to minimal expenses and membership renewals.

Balance Sheet – Cash at Bank as at 31 August 2021 $125,589.

The report was moved by Shaun Pereira, seconded by Sandra Bartlett, and accepted.

Membership Update – Sandra Bartlett, Membership Co-ordinator

- Sponsor spotlights on Facebook

https://www.facebook.com/narellanchamber - Some renewals for membership are due presently and with the AGM approaching in October, you will need to be a renewed/fully paid member to vote at that meeting. Reminder that memberships are rolling/anniversary based – from the month you joined.

PANELISTS – Today’s Very Different Operating Environment

Human Resources – Belinda McLean of HR Focus

- What policies/documentation does a business need relating to COVID

- Coronavirus Policy which should include specifics around attendance at work if showing symptoms, QR Code check in compliance, what to do if exposed to COVID, guidelines for client interactions, hygiene guidelines, social distancing and mask wearing.

- COVID Safety Plan – every business needs to have one and these can be downloaded from NSW Health and are industry specific.

- Vaccination Policy – every business will need to consider their stance on vaccination – is it encouraged, is it required.

- COVID SWMS & also a COVID Risk Register

- Toolbox talks – documenting COVID safety requirements.

- Do I have to pay staff who have to isolate due to COVID exposure at work?

- NSW has an isolation payment of $320 and can access the Federal Government Disaster payment. Staff are only entitled to sick leave if they get sick. You can agree to pay staff other leave.

- Can an employee claim Workers Compensation if they get COVID at work?

- To claim Workers Compensation the employee MUST have contracted the virus during the course of their employment, and their employment must have been a significant contributing factor. icare has advised that each claim will be considered on its individual merits.

- icare also states under Section 44 of the Workplace Injury Management & Workers Compensation Act 1988, employers have an obligation to notify icare within 48 hours of becoming aware that a worker has received COVID-19 diagnosis. Even if not sure if contracted at work.

- https://www.icare.nsw.gov.au/icare-coronavirus-information/how-covid-19-claims-are-assessed

- Vaccinations what to consider

- The Premier Gladys Berejiklian made the following statement last week: “if you’re a business, make sure your employees are vaccinated”

- How many of your staff are vaccinated – as a business you are permitted to ask this question. Recommend surveying your team to get real data.

- If a staff member isn’t vaccinated – what if any restrictions do you need to consider to ensure their safety ie should they be customer facing?

- Can a business force staff to be vaccinated? This is not a yes or no answer, it depends on if there is a Government mandate in place.

- Legislation and public health orders requiring vaccination again Coronavirus

- The NSW Government has issued public health orders preventing people working in specific types of jobs in NSW from entering the workplace or providing services if they haven’t received a COVID-19 vaccination. The orders apply to:

- Quarantine workers

- Transportation workers

- Airport workers

- Construction & authorised workers who live in declared areas are also required to have a COVID-19 vaccination

- Police, aged care workers, teachers & childcare workers.

- For detailed information about these requirements go to Public Health Orders and Restrictions (NSW)

- The NSW Government has issued public health orders preventing people working in specific types of jobs in NSW from entering the workplace or providing services if they haven’t received a COVID-19 vaccination. The orders apply to:

- Stand down direction and returning to work

- Staff who have been stood down can be partial or fully stood down

- Employees can access leave by agreement during a stand down (but if business is not financially able to pay, you aren’t forced to pay leave)

- Public Holidays are required to be paid during stand downs

- Employees still accrue leave (annual, sick & LSL) during stand down periods

- Refusal to return to work following a stand down – you can direct staff to return to work. Provide the direction in writing.

- Redundancy

- Redundancy occurs when the employer doesn’t need the job to be done by anyone or the business closes down.

- Redundancy can be due to introduction of new technology, slow down in business, closes down, relocates or restructures.

- Redundancy needs to be genuine (job no longer required), and employer needs to follow appropriate consultation.

- Small business employers maybe exempt from redundancy payments, some Awards have industry specific redundancy requirements (always check the Award).

- You do need to consult with all staff that are possibly impacted.

Commercial, Rent & Employment Law – Rahul Lachman of Marsdens Law Group

- Retail and Commercial Leases – Relief packages available

- Government has extended the 2020 regulations to this COVID lockdown which prevents landlords from terminating leases and calling on security bonds due to non-payment of rent. Also prevents the landlord from increasing the rent until at least 13 January 2022. There are also relief packages for landlords such as land tax relief and hardship payments.

- Tenants, how to qualify for this relief – you have to prove at least 30% decline in turnover, links back to the grants available. Landlords should be granting the same proportion of rent relief as turnover decline.

- Landlords cannot terminate tenants at this time unless mediation with NCAT advises so, refer National Code of Conduct.

- If you are a landlord and you grant rental waivers are entitled to land tax relief for the same proportion.

- Landlords can also get up to $3,000 per month hardship package – capped at the rental waiver provided to their tenants.

- Something similar for residential landlords up t $1,500 per month.

- Contractual issues – impact of COVID

- Forced majeure clauses (relieves apart from performing its contractual obligations due to an event outside the reasonable control of the affected party). Business owners should be going through contracts with suppliers to see if this is applicable.

- Employment Law

- There is a legal challenge pending in the Supreme Court regarding compulsory vaccination – claiming unconstitutional against basic human rights.

Mental Health Wellbeing and COVID – Josephine Byrnes-Luna of Achieving Solutions Counselling and Mediation Services

- What can we do?

- Where can we focus?

- Take a step back

- Value of time together and time apart

- Wise time choices

- Recognising the important of time, what it means

- Other things to consider

- The little and not so little jobs around your home – Together

- Game time

- Staying in touch – being creative

- Movies and books

- Light exercise and what you may feel and realise from this

- Nutrition – ok most of the time!

- A few more ideas

- Overthinking, what does it really do?

- Planning for time and things on the other side

- On a final note

- Remember to focus on the positive, it doesn’t matter how small it may seem

- Managing our health and wellbeing

- How will we do that?

- What we can and what we can’t do?

COVID-19 Stimulus Measures – Karina Rauch of Kelly Partners Chartered Accountants

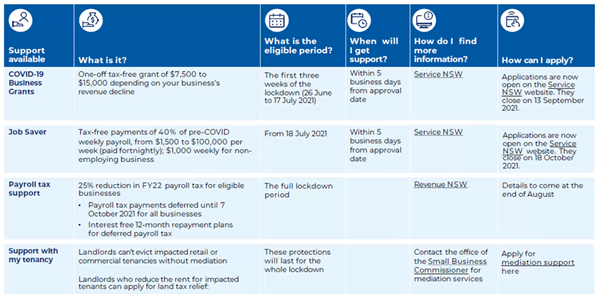

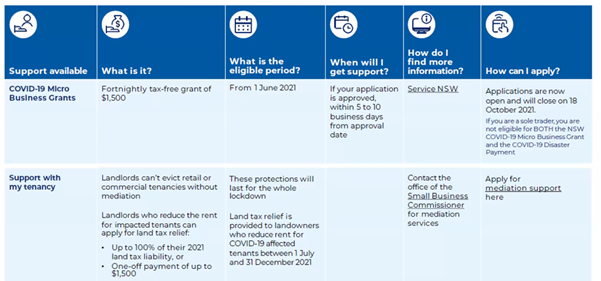

- Business grant, JobSaver payments, MicoBusiness grant, Small business fees & charges rebate, COVID-19 Disaster payment, Tourism support package, Payroll tax support, Residential tenancy support payment, COVID-19 Land tax relief, Commercial landlord hardship fund.

- Are you eligible, its not too late to apply – see your Accountant

- COVID-19 Small Business Relief Packages

- Designed to help businesses and their owners in the effort to prevent economic distress

- Goal is to minimise cashflow constraints

- Can be used to cover business expenses including, but not limited to, rent, utilities, financial and legal advice, marketing and communications, perishable goods, and salaries and wages

- Also available for sole traders and non-for-profit organisations

- Eligibility criteria has changed since packages originally announced. Refer to who is providing the assistance.

- COVID-19 Disaster payments for workers

- Designed to help alleviate pressure on business owners if you need to reduce staff hours to survive

- Tax free income and the recipient (employee) does not need to include it in their tax return

- The onus is on the employee not the employer

* * *

Sandy thanked the panellists for the very informative presentations – please reach out to them if you have further questions.

Question time was opened, and members asked questions including privacy of workers relating to vaccine for work, COVID plans and what businesses should have them, QR codes for premises and/or job site attendance, employer signs to look for regarding staff not coping, vaccines for employees who live in a lockdown LGA to travel outside their LGA.

Closing Remarks – Shaun Pereira

Shaun thanked Sandy all the panellists.

Approximately 42 attendees online for this meeting.

The next meeting will be virtual given current lockdown orders – the AGM on 13 October 2021. There will be forms that will need filling out – please keep an eye out in the emails for these.

Remember to check in on your colleagues, loved ones and neighbours and keep well.

There being no further business, the meeting was closed at 6.00pm